The Delegate #001: Apes lead the way

BAYC acq. Punks, Limewire's back, LayerZero beta launch

March 17th, 2022

I asked 60 people what they want to know about web3/crypto.

They said they wanted to know “everything”, but specifically what’s real about web3 and what’s not. How is web3 actually impacting the world outside of speculation?

So here we are: I’ll pick out the most relevant headlines and give you the summary, the context and the “so what?”, written for people who want to keep up with web3 without dealing with Crypto Twitter.

My focus is on trends, progress and new use cases, not “price go up” speculation.

In this week’s update:

BAYC: A landmark acquisition.

LimeWire: Yes, it’s back.

LayerZero: A peek into the future of blockchain architecture.

It's the Planet of the Apes

Less than a year after launch, Yuga Labs, creators of the Bored Apes Yacht Club (BAYC), announced they acquired the CryptoPunks IP.

The acquisition caps a lightning first year for BAYC, which included a $3.4 million sale and a Hudson River yacht party.

How the Apes took over

CryptoPunks had long been known as the "original NFT".

But that's about where they stopped: satisfied with using that moniker to justify price tags of millions in stuffy auctionhouses.

Meanwhile, the creative forces behind BAYC took profile picture NFTs to the next level, dropping:

Merchandise, including a cheeky rug collab with The Hundreds

An NFT serum that could generate a new Mutant Ape from your Bored Ape

Ape Fest, their first in-person event

...all resulting in a white-hot fan base that flipped BAYC's floor price over the Punks'.

Innovation is worth way more than 5 years of legacy.

What's ahead for NFTs?

Much of the NFT craze of 2021 followed the Punks template - 2,000 to 10,000 procedurally generated JPEGs.

Though they also followed that template, BAYC was one of the few projects to push the envelope of NFT culture. They’re on track for more, starting with ApeCoin, the new currency at the center of their ecosystem. What it actually will do is TBD.

Still, we have only scratched the surface of what NFTs could be.

Today, NFTs roughly mean “art” or “inflated cartoon JPEGs” for most people. But remember that "NFT" itself is only a technical code standard for unique things, which can be used to represent almost anything.

The question: which things are obviously better as NFTs? That is still unclear, even for art.

So while we’ve seen an NFT craze today, we're not even close to discovering the real potential of NFTs tomorrow.

Quick ones

Bitcoin lives: The EU shot down a potential ban on proof-of-work (read: Bitcoin)

Stripe emerges: Stripe announces support for crypto businesses

Fad no more: Bessemer Venture Partners announces a $250 million fund, 7 months after a partner calls web3 a “fad”

Calls, puts, perps, oh my!: Coinbase discusses their upcoming derivatives business, days after FTX seeks US approval for retail margin trading

International speedrun: FTX is first to earn Dubai license and looks to Africa

The 2000s are calling...

...and they want NFTs?

LimeWire (yes, that one) is back with a plan to build a new NFT marketplace, with an initial focus on music NFTs.

LimeWire is building on Algorand, an Ethereum competitor. Algorand needs this win: though it announced a $300M fund to incentivize developers back in September 2021, there are no projects of note on the chain.

Per the news release, the LimeWire strategy focuses on two parts: streamlining (easy signups, credit card purchases, pricing in dollars) and focusing on music.

Should we take it seriously?

I'm doubtful.

First, low-tier Ethereum competitors often seek out big-name partnerships, but none of them have made notable gains.

Tezos/Manchester United, Cardano/DISH Network and Hedera/Ubisoft have all announced partnerships. Yet, after all this time, most traffic and NFT volume still lives on Ethereum.

Second, OpenSea is still king, having endured the strongest challenge from LooksRare. After recording hundreds of millions in transaction volume during its incentive campaign, LooksRare still sits at just 8% of OpenSea's volume.

Besides, players like Voice are already trying similar tacks to what LimeWire is proposing.

Goes to show how hard it is to convince even a touch of the masses to move to new protocols.

Itching for change

The NFT marketplace category is on my watchlist right now.

The ecosystem is broadly unhappy with OpenSea's centralization. OpenSea's fees are excessive, and it controls too much of the web3 experience.

Many marketplaces are trying to compete - LooksRare was just the latest - with more on the way (Softbank, Coinbase).

What’s down the road? Tasha Kim argues for an unbundling of OpenSea. Infrastructure-level innovations like Reservoir are making it easier to build competitors, especially niche/community-specific ones.

Inventing zero

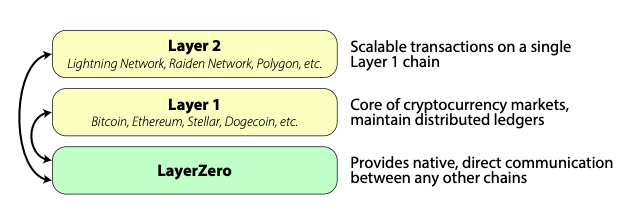

Scalability is the name of the blockchain game right now. There’s a whole page to be written that outlines the various focus areas within scalability.

One of them is interoperability: how do we make existing blockchains talk to each other?

There’s another page to be written outlining approaches to interoperability, but one of the solutions you should know about is LayerZero.

LayerZero, live

This week, LayerZero announced they are live across 7 chains, with 4 coming in the next months.

LayerZero allows contracts on different chains to interact with each other. Developers can use LayerZero to build cross-chain experiences.

That’s really vague, so here’s an example of an experience pre-LayerZero:

Find an Ethereum exchange, click “swap” on Ethereum to trade A for B

Find a bridge, click “bridge” to move B from Ethereum to Avalanche

Find an Avalanche exchange, click “swap” on Avalanche to trade B for C

To make it work, you have to be connected to the right chain (Ethereum or Avalanche), and you have to initiate each step yourself.

With LayerZero, the Ethereum exchange could message across chains, meaning you can tell it to swap “A on Ethereum” to “C on Avalanche” and it would know how to move tokens to Avalanche then swap them with a single click.

Here’s a video demo of what that looks like.

More than saving clicks

Ethereum killers were a big 2021 theme. “L1” competitors like Solana, Avalanche, Harmony, etc. all became prominent names as Ethereum became slow and expensive.

Ethereum won't die at the hands of these competitors. But their successes made a "multi-chain" world much more likely.

But believing in a multi-chain world means confronting a lot of other questions.

The most obvious one: If life on just Ethereum is already confusing for the average person, how much harder would the "multi-chain" world be?

The best experiences in the future will hide all this mess at the blockchain level from most users. People shouldn’t have to know anything about blockchains - it should just work.